The market landscape is marked by a series of scandals surrounding battery fires in electric vehicles and, simultaneously, the rapid spread of these cars. Indeed, there are currently a vast number of second-hand electric cars aged 2-4 years on car dealership lots, which are almost equal in price to petrol or diesel ones. These vehicles typically have batteries in excellent condition and moderate mileage. However, all these rumours about batteries catching fire deter people from purchasing not only used but also new electric cars. Adding to this are rising customs tariffs that could potentially send the prices of electric vehicles soaring. Buyers certainly have a lot to consider.

On 25 August, the South Korean government announced that it would launch a battery certification system for electric cars in October. Han Zeea, a spokesperson for the ruling People Power Party, informed journalists about this development. Under this system, the government will require car manufacturers selling electric vehicles in the Republic of Korea to identify the batteries installed in them.

It seems the Korean government is taking further steps after urging car manufacturers to voluntarily disclose such information following a major incident on 1 August. This most extensive fire involving an electric vehicle occurred on 1 August in the South Korean city of Incheon, in the underground garage of a block of flats. The fire involved an electric Mercedes-Benz sedan equipped with batteries from the Chinese company Farasis Energy. Incidentally, Mercedes-Benz was then forced to disclose its battery suppliers at the request of state authorities.

The August fire was so intense that it took over eight hours to extinguish, with more than 100 vehicles damaged. Several dozen people suffered moderate smoke inhalation and were hospitalised, but fortunately, everyone survived. A subsequent investigation revealed flaws in the sprinkler system, which was supposed to extinguish the fire with water.

The problem with extinguishing an electric vehicle fire is that even if the flames are put out, a damaged battery can reignite after some time due to ongoing chemical reactions within the battery. In the EU, additional cooling of the battery is carried out for the complete extinguishment of electric vehicle fires. For this purpose, a special water container is even used. Thus, extinguishing an electric vehicle fire is a complex task and quite dangerous for firefighters and those nearby.

In addition to the serious issues in the event of a fire, electric vehicles have other drawbacks, such as the degradation of battery cells, which account for a large portion of the car’s total cost. Batteries lose their ability to hold the manufacturer-specified charge level over time.

It appears that the safety regulations for electric vehicles being introduced in South Korea will likely be copied in EU countries and other developed nations. As a result, these vehicles may become safer but possibly more expensive.

Moreover, the cost of a new electric vehicle is significantly higher than that of a comparable petrol or diesel engine vehicle. Initially, there were also concerns about the availability of fast-charging stations and the relatively short range on a charged battery. However, these two issues have largely been resolved over the past 2-3 years. The cost of new cars is quickly approaching that of their petrol counterparts, and the network of fast-charging stations is becoming increasingly extensive.

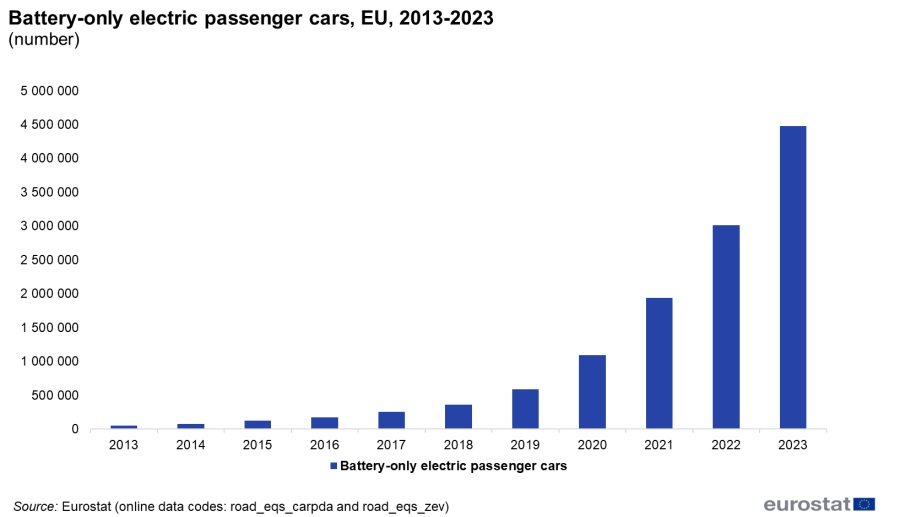

Photo: The growth of electric vehicles in the EU over the past 10 years. Source: Eurostat

The EU Chooses Electric, But Not Everywhere

The advantages of electric vehicles in Europe have been bolstered by a robust system of government incentives for purchasing such cars, significantly enhancing their appeal. As a result, the number of electric vehicles has surged in Europe over the past few years.

By the end of 2023, the number of battery-electric vehicles (BEVs) in EU countries exceeded 4.4 million, which is approximately 89 times more than in 2013 and 12 times more than in 2018. The highest growth rates were observed between 2019 and 2021, with a 3.24-fold increase over two years. Overall, in the last 10 years, the share of electric vehicles in the total number of passenger cars has increased from 0.02% to 1.7%. However, in some EU countries, the share of electric vehicles has grown even more.

For example, Germany is the leader among EU countries in purchasing new electric vehicles in absolute numbers – by the end of 2023, 524,000 electric cars were sold out of 2.8446 million new cars. This means that approximately 18.4% of buyers in Germany prefer electric vehicles when purchasing new cars. The second-largest market is France, where buyers purchased 303,600 electric cars out of 1.8173 million new vehicles, or 16.7%.

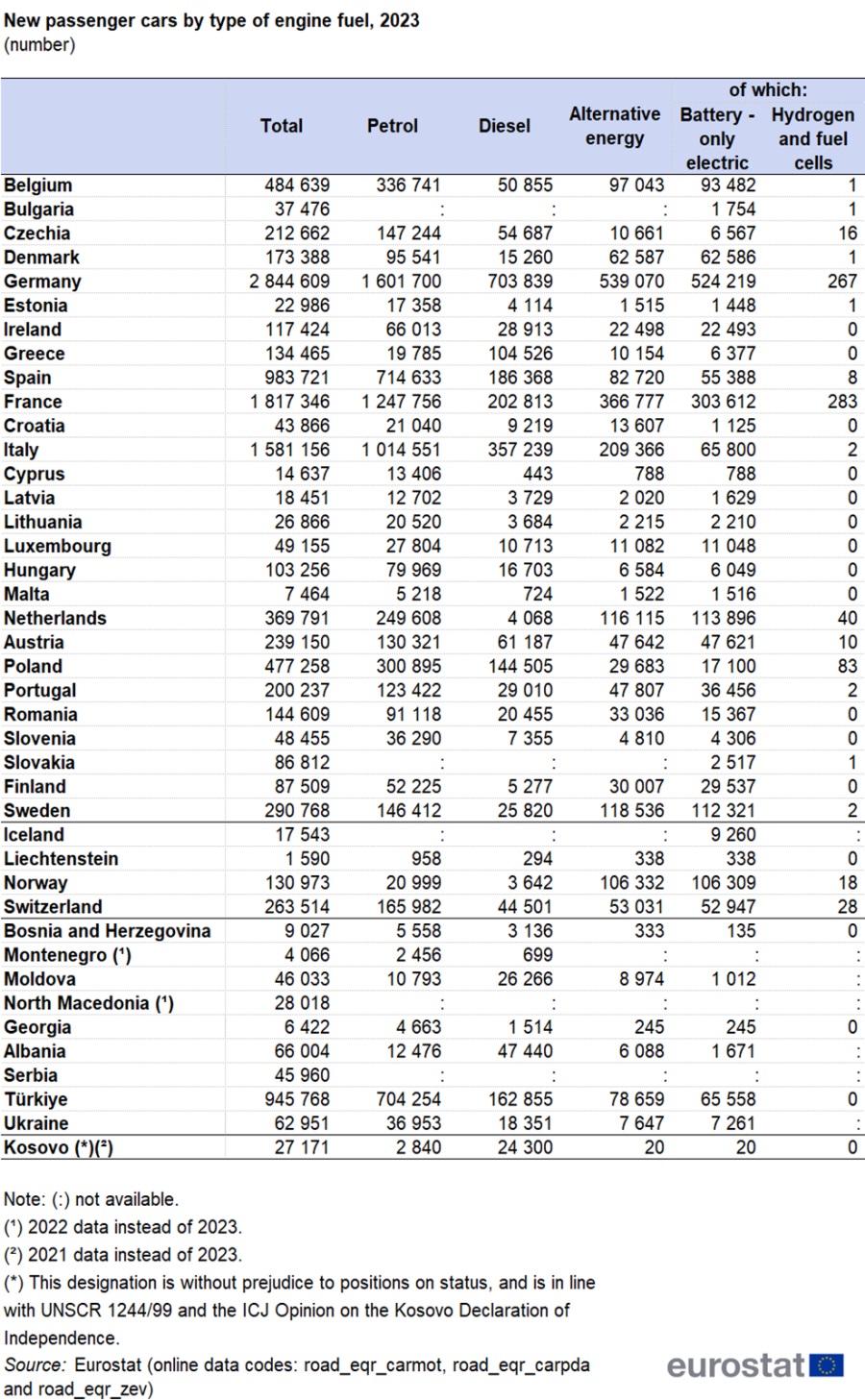

Photo: How Europeans bought new electric cars in 2023. Source: Eurostat

Electric cars are even more popular in Northern European countries (figures as of the end of 2023):

- Norway (not an EU member) – 106,300 out of 130,970 new cars, or 81.2%;

- Sweden – 112,300 out of 290,800 new cars, or 38.6%;

- Denmark – 62,600 out of 173,400 new cars, or 36.1%;

- The Netherlands – 113,900 out of 369,800 new cars, or 30.8%;

- Switzerland (not an EU member) – 52,900 out of 263,500 new cars, or 20.1%;

- Belgium – 93,500 out of 484,600 new cars, or 19.3%;

- The United Kingdom (not an EU member) – 314,700 out of 1.768 million new cars, or 17.8%.

Italy and Spain are relatively large markets in terms of the total number of new cars purchased, but electric passenger cars are not popular there at all:

- Italy – 65,800 out of 1.581 million new cars, or 4.2%;

- Spain – 55,400 out of 983,700 new cars, or 5.6%.

Outside the EU, in addition to the UK and Norway, there are other significant markets for electric vehicles – Turkey and Ukraine, which is currently at war. In Turkey, by the end of 2023, 65,600 electric vehicles were sold out of 947,800 new passenger cars, accounting for a market share of 6.9%.

Ukraine is in an interesting situation: the country has a relatively low purchasing power and significant problems with energy supply due to Russian attacks on its energy infrastructure, including systematic power outages. Nevertheless, Ukrainians are actively buying new electric cars and also importing used ones. The popularity of electric passenger cars in Ukraine is even higher than in Turkey: in 2023, 7,300 electric cars were purchased out of 63,000 new passenger cars, representing a market share of 11.6%.

This popularity is because electricity prices for domestic consumers in Ukraine were relatively low until recently. However, in June 2024, the relevant price tag was increased by 64%. How popular electric cars will be under such conditions remains to be seen.

Firefighters’ main advice is to immediately flee an electric car if it starts burning and to stay about 40 metres away until the firefighters arrive, as a burning battery can be unpredictable.

How have the scandals surrounding battery fires affected the market? Quite predictably: regulators are already demanding that information about battery suppliers used in car production be disclosed not only in China but also in EU countries and other nations. It is possible that additional safety requirements for such batteries will be introduced, which could increase their cost in the short term, as safety does not come free of charge.

What’s Next for EV Prices?

According to data from Statista, in 2016, the battery made up 49% of the cost of an average electric vehicle. This figure has dropped to 28% this year and is expected to decrease to 25% by 2026. Furthermore, the share of batteries in the cost of electric vehicles is projected to decline by about 1.5% annually until 2030.

So why aren’t electric car prices approaching those of diesel and petrol vehicles as quickly? After all, battery packs are still the most expensive component of electric vehicles. It seems that electric cars retain the image of being trendy and innovative products, leading customers to be willing to pay a premium. It might be surprising, but government subsidies are also supporting prices. Without these subsidies, manufacturers would be forced to offer more competitive prices against fossil-fuel vehicles. With subsidies, companies rely on these state payments for more “environmentally friendly” cars.

Another factor that came into play this year is the tariffs imposed by the EU and other countries to protect their markets from an influx of cheap Chinese electric cars. Since 4 July, the EU has introduced preliminary safeguard tariffs on Chinese electric vehicles ranging from 17% to 38.1%, depending on the manufacturer. An exception is Tesla, which saw its tariff reduced to 9% in August from the previously set 20.8%. All these tariffs are in addition to the EU’s standard import duty on electric vehicles of 10%. What’s next? It is likely that the investigation will conclude with these tariffs being extended on a long-term basis from November 2024.

Turkey has also imposed a high import tariff on electric vehicles—40% as of March 2024—which is effectively a prohibitive level. In reality, Turkey is not so much protecting its market with this tariff as making a strong proposition for Chinese automakers to relocate their assembly plants to its territory. Turkey has a free trade zone agreement with the EU, so cars assembled in Turkey should not be subject to the restrictions that the EU imposed in July 2024.

Chinese manufacturers are already taking action to avoid such tariffs on their electric cars sold in the EU. For example, the largest Chinese electric vehicle manufacturer, BYD, has begun projects to produce vehicles in Turkey. There are also strong ties between Chinese battery and car manufacturers and Hungary, which is a member of the EU. Thus, Hungary is being considered as a hub for importing Chinese-made cars into the EU. So, even with high restrictive tariffs, relatively cheap Chinese electric cars will still find their way into the EU.

It’s not just the prices displayed at car dealerships selling electric vehicles that matter. It seems that the cost of owning an EV will increase following a series of incidents with batteries. This increase will primarily occur due to the rising costs of insurance policies and electric charging. While owners may optimise charging costs with their own charging stations and solar panels, dealing with insurance policies is much more complicated.

Insurers believe that the consequences of serious battery incidents can be divided into two categories. The first is damage and fires resulting from road traffic accidents (RTAs). These are fairly straightforward, with probabilities similar to those of conventional vehicles.

However, there is one significant difference: fires are a rare consequence of accidents involving internal combustion engine vehicles. Even in cases of fire, the participants in an accident often extinguish it with their own fire extinguishers. The consequences of accidents involving electric vehicles are much more severe in most cases. Even minor damage to the battery can lead to a prolonged fire that can completely destroy the car.

Thus, electric vehicles face a high risk of total destruction even in relatively minor accidents. Naturally, insurance companies are already factoring this into the cost of policies.

Photo: Mercedes-Benz EQB350 after a fire that occurred while charging on a DC fast charger. Johor, Malaysia. Source: Facebook/JohorPost

The second type of incident with electric vehicles is battery fires without an accident. This includes fires caused by manufacturing defects, power supply incidents, or other reasons. Such incidents are virtually unknown with internal combustion engine vehicles, except in cases of electrical wiring faults. Thus, compared to traditional vehicles, electric cars pose additional risks, which must be accounted for in insurance policy costs. The recent surge in fire cases will certainly provide insurance companies with additional arguments.

And that’s not all: the severe consequences of electric vehicle fires will likely lead to an increase in third-party liability insurance premiums. For example, in the event of an electric car fire spreading in a public car park or a private parking garage under a block of flats, the damage could be significant. The harm caused to third parties by such a fire could be much greater than the typical consequences of a fire involving a petrol or diesel car.

What can counter these factors that may increase the cost of owning electric vehicles? Perhaps the expected significant increase in battery life and government programmes encouraging the purchase of electric cars. As for the programmes, they will likely be strengthened in line with the pace of the “green transition”.

As for the increase in battery life, there is hope for the development of solid-state electric batteries. These are expected not only to have more charge-discharge cycles but also to degrade more slowly during use. Furthermore, there is hope that solid-state batteries will be less prone to incidents than current lithium batteries. However, it should be noted that the transition to innovative batteries may temporarily increase the price of cars equipped with them.

Source: The Gaze