The Ukrainian offensive in Russia’s Kursk region is gradually expanding to the east and north. From the early stages of this advance, Ukrainian forces took control of the small Russian border town of Sudzha, home to a Russian gas hub responsible for exports to Western Europe via Ukraine. This development would likely raise additional risks for gas supplies to European consumers. However, two weeks into the Ukrainian offensive, gas prices in the European market have not significantly increased. So, what should we actually expect regarding gas and electricity prices? What is the likelihood of a price shock similar to that experienced by EU countries in the autumn of 2022?

On 19 August, the Ukrainian offensive continued in the Kursk region, despite growing Russian resistance. The town of Sudzha, with its gas hub, is now more than 20 kilometres from the front line. However, this does not guarantee that this important technological hub is secure. Firstly, it remains within the range of Russian heavy artillery and multiple rocket launcher systems. Secondly, the Russians are actively using glide bombs, which have been hitting Ukrainian territory, not to mention towns and villages along the Ukrainian-Russian border.

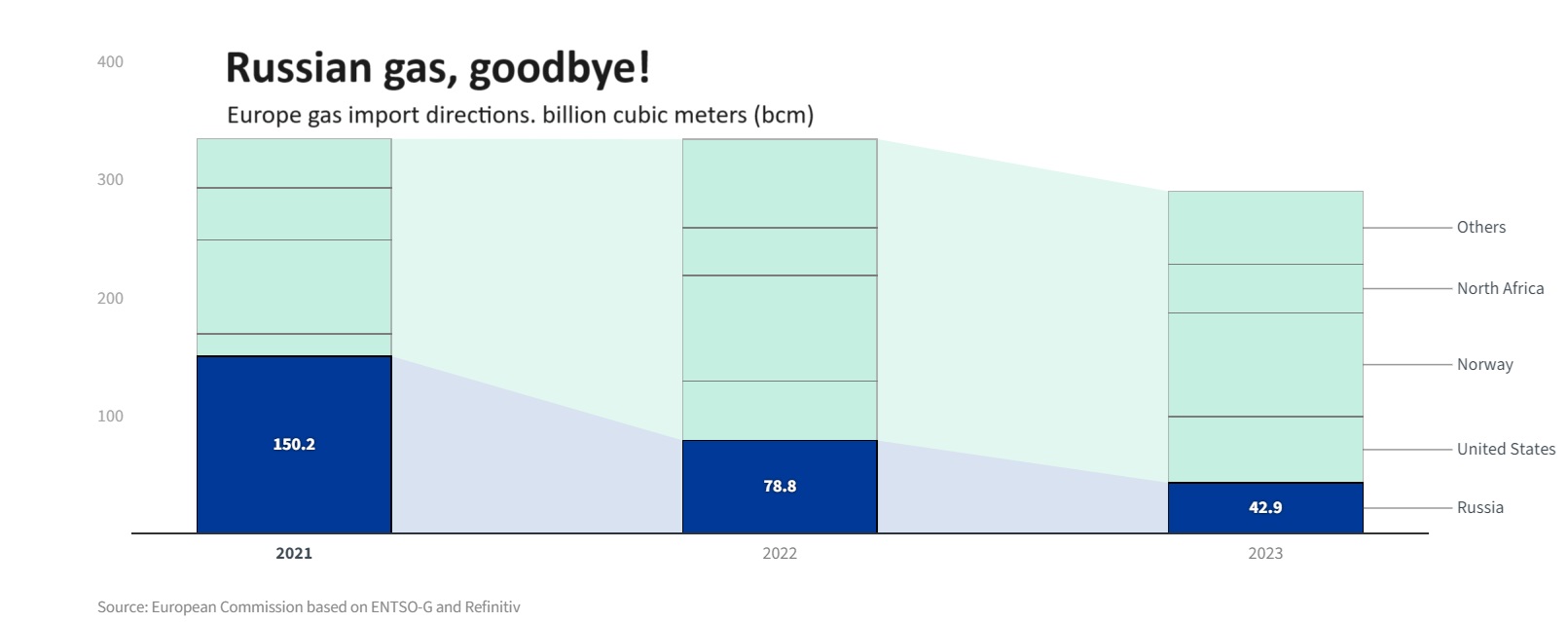

Therefore, while there is a risk to Russian gas exports via pipelines, these exports continue at the same volumes as before the Ukrainian offensive. The most important aspect of this situation is that, due to active efforts to reduce imports of Russian gas via pipelines, volumes have dropped from 153 billion cubic metres in 2020 to 67 billion cubic metres in 2022. By the end of 2023, Russian gas imports via pipelines had fallen even further to 27 billion cubic metres, of which approximately 14 billion cubic metres were transited through Ukraine—specifically, through the gas metering hub in Sudzha.

Currently, Russian gas transit through Ukraine accounts for approximately 4.6% of European gas imports, serving only four EU consumers: Slovakia, Hungary, Austria, and Italy. A small amount of Russian gas also goes to the unrecognised Pridnestrovian Moldavian Republic (PMR). This entity has existed in the eastern part of Moldova since the early 1990s, when, with Kremlin support, local separatists, aided by former Soviet military units, declared the PMR. Although the volume of Russian gas supplied to the PMR is negligible compared to the overall transit, these supplies are critically important for the self-proclaimed entity.

Photo: Directions of gas imports into Europe: Russia’s share is rapidly declining. Source: European Commission

The Offensive Does Not Affect Prices

On 6 August, Ukrainian assault groups quickly advanced from the border deep into Russian territory. According to Radio Free Europe/Radio Liberty, an analysis of satellite images following the Ukrainian military’s attack indicates that some damage to the Sudzha gas metering station occurred between 9 and 10 August, with further damage visible between 10 and 11 August. The images from 11 August show that one administrative building was almost completely destroyed, along with one of the sites where measuring equipment was installed.

There were no actual combat operations on the grounds of the Sudzha gas hub, according to reports, which is unsurprising given that this facility is located less than a kilometre from the state border between Ukraine and Russia. However, after Ukrainian forces moved forward, Russian forces began shelling the rear of the Ukrainian group with artillery, rockets, and glide bombs, much like they have been bombarding Ukrainian territory since the 2022 invasion and up to the beginning of the Ukrainian offensive.

Despite this, the Ukrainian side reported that gas transit continued as usual. It is also known that on 8 August, Gazprom stated that transit through the Sudzha gas reception point was set at 37.3 million cubic metres per day, slightly below the usual figure of 42 million cubic metres. The next day, Ukraine’s state company LLC Gas TSO of Ukraine confirmed this.

Furthermore, the Ukrainian operator reported that Gazprom increased its transit request through the Sudzha gas metering station from 39.6 million cubic metres on 12 August to 42.4 million cubic metres on 13 August. Transit continued at approximately these volumes and had not ceased at the time of this article’s publication.

Photo: Satellite image analysis following the Ukrainian military attack indicates, according to Radio Liberty, that damage at the Sudzha gas metering station appeared after 9 August, a few days after Ukrainian forces took control of it. The image on the right shows craters from shell or missile strikes. Source: Radio Liberty

In other words, if gas transit through Ukraine is disrupted due to the war, it will likely only happen if Russian forces inflict irreparable damage on the Sudzha gas metering station. How likely is this? Only the Kremlin may know. It is worth recalling that since March 2024, Russian forces have repeatedly attempted to destroy the surface infrastructure of Ukraine’s underground gas storage facilities in the Carpathians with missile strikes. The Russians used very expensive and scarce Kinzhal hypersonic missiles for this purpose.

However, these were attacks on the part of the gas transmission system primarily used by Ukraine. Meanwhile, Russia’s Gazprom, which is already unprofitable due to restrictions on the purchase of Russian gas in the EU, is very interested in maintaining transit through Ukraine. The export of the volume of gas pumped through Ukraine currently provides Gazprom with approximately $5 billion per year. Russia earns a similar amount from gas exports to the EU through the TurkStream pipeline, which runs along the Black Sea floor.

The Price? Sudzha Has Little Impact

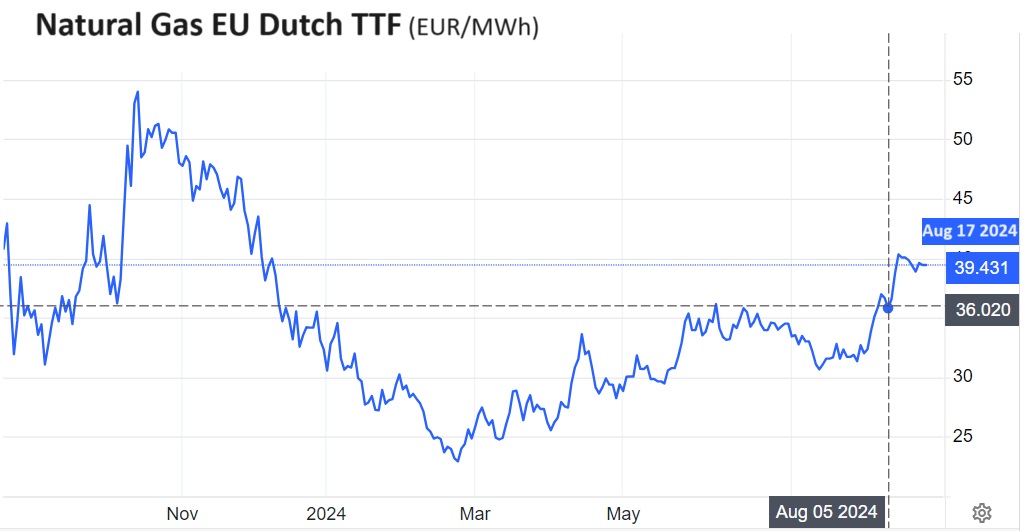

After 6 August, gas prices in the EU saw a slight increase. Predictably, the media and many experts were quick to link this to the Ukrainian offensive. However, the rise in gas futures prices in August and the latter half of July is a seasonal occurrence that happens every year. This year, it began in mid-July, with prices increasing from approximately €250 per thousand cubic metres to €353 before the Ukrainian offensive—an increase of about €100. From 5 to 17 August, prices rose to €405 per thousand cubic metres, an additional €52 increase. As we can see, the latest rise was significantly smaller, and it also has a seasonal component.

The problem lies in the fact that three countries—Austria, Slovakia, and Hungary—are heavily reliant on the pipelines that export Russian gas to Europe. However, this statement is somewhat outdated; the word “are” should be in the past tense.

Austria, Slovakia, and Hungary now have the technological capability to stop purchasing Russian pipeline gas. Yet, the local elites in these countries still maintain close ties with Moscow, benefiting from special conditions on Russian gas imports with tailored pricing formulas. As a result, their actual gas prices may differ significantly from the current market rates.

Next period will be uncomfortable for these three countries, but for everyone else, it will go largely unnoticed. Ukraine could have halted gas transit as early as 2022, considering Russia was earning tens of billions of dollars from gas exports, with a significant portion of that revenue funding the war. However, unilateral action would have caused considerable irritation in Brussels, something Kyiv could not afford, given the critical importance of partner support. Over the past two and a half years, the EU has effectively eliminated its dependence on Russian gas. Thus, if transit is eventually halted, it will be seen as a long-anticipated event. The market will perceive it as “the other shoe finally dropping.”

Photo: The price of gas futures contracts at one of the key EU gas hubs in euros per MWh. The data on 5 and 17 August correspond to future prices of €353 and €405 per thousand cubic metres, respectively. Source: tradingeconomics.com

What guarantees price stability for gas in the 2024/25 season?

First, the massive reduction in the share of Russian gas, which has been replaced primarily by liquefied natural gas (LNG) supplies from North Africa (primarily Algeria) and the United States.

Second, the reduction in gas consumption and imports in the EU. For instance, in 2020, the EU imported 394 billion cubic metres of gas, while in 2023, it was only 290 billion cubic metres—a decrease of more than a quarter.

Third, record-high gas reserves in European underground storage facilities, about 88% of their capacity is filled. These reserves are typically accumulated every summer when prices are lower, to be used in the winter during peak demand.

Fourth, the China factor. While this is not a lever controlled by Europe, a slowdown in China’s economic activity is expected to reduce global demand for LNG, creating conditions for lower prices in the EU. LNG is indeed a highly liquid commodity, not tied to pipelines. Over the past two years, the EU has significantly expanded its infrastructure for importing LNG by sea.

At this point, it’s worth mentioning the sabotage of the “Nord Stream” pipelines—1 and 2—and the potential Russian involvement. Could the Kremlin, with its penchant for hybrid tactics, resort to attacks on European gas infrastructure to restore dependency on its pipelines and drive gas prices to thousands of euros per thousand cubic metres or even higher? They dream of it. But the EU’s gas import and distribution infrastructure has now become so decentralised that even the most severe acts of sabotage would have little effect.

Source: The Gaze