In the realm of “from the obvious to the incredible,” after three years of exorbitant food inflation, the trend might be shifting. However, certain products prices are still on the rise. The crux, though, lies in the fact that Ukrainian food, following a hot autumn, has been actively exported, despite Moscow’s efforts to stifle competitors and unilaterally capitalize on the artificial shortages of wheat, corn, and oilseeds it created. Thanks to Ukraine’s persistence and the expertise of Western European partners, a shortage was averted. Argentine farmers also played a crucial role.

After three years of price shocks triggered by natural disasters and Russia’s war against Ukraine, some stability is gradually emerging in the global food market.

In 2024, several uniquely favourable factors in agriculture promise good news for consumers. It appears that prices for essential food products, at the very least, will halt their ascent, and in some cases, even decline.

According to Rabobank’s forecast, specializing in food and agribusiness, an oversupply is expected to form for certain products, pushing prices down. This includes sugar, coffee, corn, and soy. However, the cost of other agricultural goods, including the fundamental wheat, will remain high.

Nevertheless, the impact of declining price trends will be more pronounced, making the average food basket more affordable.

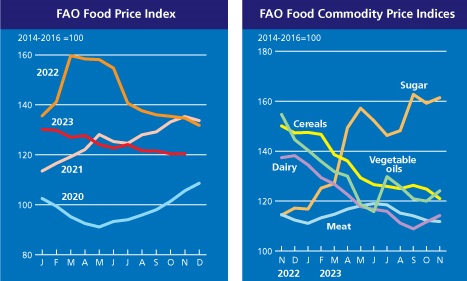

The trend towards cheaper prices has been strengthening for a few months now: according to FAO data, global prices for food items decreased by 0.5% in October 2023. In November, FAO’s food price index averaged 120.4 points, remaining at the same level as the previous month. However, the food price index was 10.7% lower than in November 2022. Has the wave of expensive products finally come to an end?

It seems so. In particular, Ukraine, along with its partners, managed to overcome the naval blockade that Russia sought to impose in the Black Sea. With some challenges, but using large vessels, food from Ukraine is being transported to Europe, Africa, and Asia. Against the backdrop of a bountiful harvest in 2023, cultivated by Ukrainian farmers in the war-torn country, the restoration of maritime logistics has significantly impacted global prices.

This year’s harvest in Ukraine, a member of the elite club of major food exporters, was so good that it led to a noticeable decrease in prices within the country. This is despite Ukraine continuing to resist Russia’s aggression in a brutal war. Notably, the National Bank of Ukraine revised its inflation forecast in October, reducing it from 10.6% to 5.8% by the end of 2023.

But by early December, it was clear that this figure would be closer to 5% by year-end. The primary factor in the rapid slowdown of inflation in Ukraine is the influence of high yields and reserves on the dynamics of food prices. Despite the war, Ukraine remains a reliable food supplier to the global market. From January to November this year, the volume of food exports reached $19.6 billion. Therefore, in early 2024, this country will continue to export food, impacting global prices and, consequently, supermarket shelves.

PHOTO: World food market prices are turning downward. Source: FAO

Prices in Decline

The most vibrant prospects on the price horizon can be found in the coffee market. Rabobank anticipates a surplus of 6.8 million standard bags in the 2024/25 coffee market, thanks to improved production in Brazil and Colombia. The trend towards falling prices became evident in the summer when global coffee prices sharply dropped in July, losing 7.2% within a month and reaching an average of £1.58 per pound, marking the lowest level in half a year.

Even robusta, whose prices reached a 12-year high last year, experienced a 3.4% decrease.

Another product poised for affordability is sugar. Like coffee, it is becoming cheaper from record highs set due to low supply last season. It is expected that sugar production in leading producer Brazil will increase by 27.4% in 2023/24 to a record 46.88 million tons, thanks to increased yields and favourable weather. Thailand, among the top three sugar producers, is also anticipating a high yield.

With favourable conditions, we hope the sweet matter will lose its edge, even in India, the second-largest producer of this product, which had to temporarily step back from the market. In October 2023, the country announced an export ban on sugar for the first time in seven years to curb rising prices in the domestic market due to a poor harvest. Domestic retail sugar prices rose by 6% from January 1.

And finally, soy. While this product does not directly affect consumers, it is crucial for the overall dynamics of agricultural markets, especially the vegetable oil market, and for animal husbandry, where soy is used as feed. Brazil is expected to harvest a record soy crop of 163 million tons.

As processed soy products are widely used in animal husbandry, the high supply of soy and its availability are expected to stabilise prices for dairy products, meat, and eggs.

Against the Grain

The main disappointment in terms of prices next year is wheat. This key consumer market commodity will become more expensive, and there are several reasons for this. The first block is market-related, linked to the reduction in global supply. In December, the forecast for world wheat production in 2023 was raised to 787 million tons, almost 2 million tons higher than the previous month, but still 2.1% (17.1 million tons) lower than the 2022 level.

However, the issue is not only the physical reduction in supply. Aggressor country Russia continues to use food as a weapon. Controlling nearly 10% of the world’s wheat exports, including through stolen Ukrainian grain, it can artificially create tension by restricting its supplies. Plans to regulate wheat exports more strictly in Russia are already being voiced. If this happens, the jump in wheat prices will drive food inflation and cause even greater tension in developing countries and, to some extent, in Europe.

However, the undisputed champion of price increases, despite all the downward trends for other goods, is olive oil. The reason lies in the catastrophic weather conditions in Southern Europe, resulting in EU olive oil producers yielding only 1.4 million tons in the 2022/23 marketing year, compared to 2.3 million tons produced the previous season.

Spain, the world’s largest producer, harvested only 660,000 tons of olives instead of the usual 1.5 million tons.

In Italy, another major oil producer, olive harvest in 2022/23 decreased by 37% compared to the previous season. The production forecast for Italy for the current season is 290,000 tons, while the industry’s average for the last four years has not dropped below 303,000 tons.

Another market leader, Greece, fell victim to both droughts and floods. As a result, olive oil prices in Europe sharply increased – by November, the increase had reached 43.5%.

Such a cent-wise imbalance is expected to spur demand for substitute products. Rapeseed oil is predicted to become the most popular culinary oil next season. Fortunately, rapeseed oil has become 17% cheaper.

ODESA REGION, UKRAINE – NOVEMBER 9, 2023 – Shipping to and from Ukrainian Black Sea ports along the temporary corridor continues despite the attacks of Russian troops on port infrastructure, Odesa Region, southern Ukraine. NO USE RUSSIA. NO USE BELARUS. (Photo by Ukrinform/NurPhoto via Getty Images)

Grey Area

Prices for fruits and vegetables remain poorly predicted as they are highly sensitive to weather conditions.

Most likely, by spring 2024, vegetable prices will increase in Western Europe by an amount equivalent to storage costs—around 5%. However, this rise is traditionally seasonal, and it is unlikely to cause consumer concerns.

What could raise concerns? Against the backdrop of a significant decline in the prices of feed crops (soy and others), meat is not rushing to become cheaper. Compared to 2022, the FAO meat price index has only decreased by 2.4%. Meanwhile, feed grain has become cheaper by a substantial 5.6% compared to October of this year due to a drop in corn prices. Overall, corn on key exchanges has fallen by a quarter over the year, and soy has decreased by roughly a tenth. In addition to the resumption of exports from Ukraine, the sharp increase in corn exports from Argentina has also influenced this disparity.

Where does these price trend gap between feed grain and meat come from? Partly, it is resistance from major producers, and partly, the cost of implementing “green” technologies plays a role. But for now, the news is promising the prospect of softer prices in supermarkets next year at all.

Source: The Gaze