Global oil prices have been on a decline for the third consecutive month. Despite OPEC+’s decision to cut production at the end of November, it proved insufficient to push prices upward. Even the most optimistic analysts doubt that oil will reach record levels and hit $100 per barrel in 2024. Additionally, active measures by the US and the EU to bring Russian oil exports back below $60 per barrel have contributed to the situation. Let’s see how this will impact petrol station receipts.

By mid-December, the cost of Brent crude had settled in the range of $76-77 per barrel, although at the end of September, this figure exceeded $90. On one hand, the absence of price fluctuations and the downward trend suggest that the energy crisis is behind us, and the oil market has adapted to operate in the conditions of anti-Russian sanctions. These sanctions force traders to seek new markets and logistical routes, depressing prices overall.

On the other hand, global oil consumption is decreasing. Europe has already filled its gas storage for the current winter, so there won’t be increased demand for oil as an alternative fuel for heating in the EU. China, struggling to revive its economy after the pandemic, is also reducing consumption. A similar trend is observed in the US, where there is still an elevated risk of recession. The impact of the “green transition,” gaining momentum not only in Europe but also in other countries, is also evident.

Recession Sneaks In

The International Energy Agency (IEA) has been revising its forecast for global oil consumption for several months now. In its December report, the agency stated that the growth of global oil demand sharply slowed down by the end of 2023. The growth rate of oil consumption in the 4th quarter will fall to 1.9 million barrels per day, compared to 2.3 million barrels per day in the 3rd quarter.

According to the IEA, the reduction in demand reflects a general deterioration in the macroeconomic climate. Oil purchase orders from Chinese refineries in December turned out to be the lowest since May 2023. However, 80% of global raw material consumption is attributed to China. Therefore, the decline in demand from this country significantly affects the entire market.

The reduction in consumption is also observed in the US, while the IEA calls oil supply in this country in 2023 “record-breaking.” In other words, production significantly outpaces demand, putting pressure on prices. WTI crude oil, extracted in Texas, has plummeted from $94 to $71.7 per barrel from the end of September to mid-December. At the same time, a slowdown in economic growth to 1.5% is expected in the US in 2024 (IMF data), casting doubt on a substantial increase in demand next year.

In the eurozone, retail sales of oil products are not meeting trade expectations. The sale of automotive fuel in EU countries decreased by 0.8% in October, continuing a five-month decline. These data indirectly indicate that the demand for oil products, and therefore oil, is falling. Although the economy in EU countries is recovering.

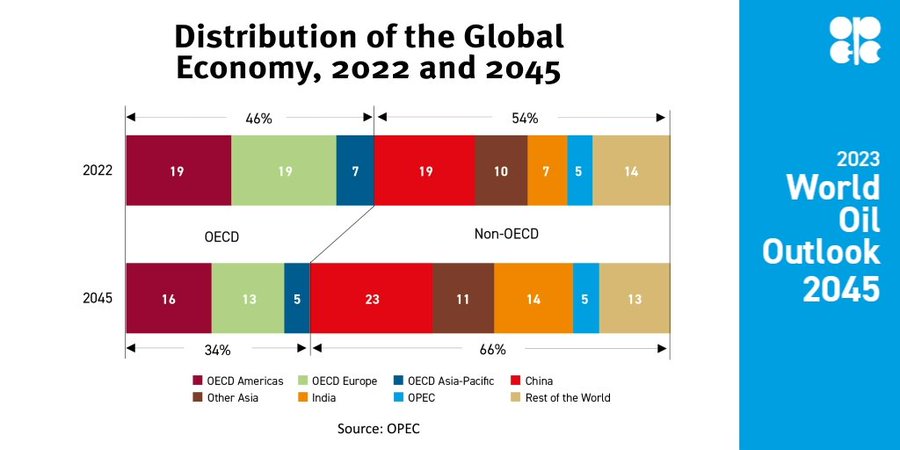

Photo: OPEC forecasts a shift in oil consumption to China and India. However, demands for an overall reduction in the carbon footprint will not allow these countries to sustain the expected level of oil consumption. Source: OPEC.

Electric Cars as a Thorn in the Side

The transition to renewable energy sources also leads to a slowdown in the growth of oil demand, disrupts the business of key manufacturers, and does not support high raw material prices.

The IEA identifies the rapid growth of the electric vehicle fleet (battery-powered cars and hybrids) as one of the main threats to the oil market. According to the analytical company Rho Motion, global electric car sales increased by 20% year-on-year to 1.4 million cars in November.

The IEA expects that around 14 million electric cars will be sold worldwide in 2023. This is 35% more than in 2022 and 4.7 times more than in 2020. But most importantly, if this trend continues, the global electric car fleet will reach 350 million units by 2030, leading to a reduction in oil consumption by 5 million barrels per day.

In 2023, the average daily consumption is approximately 101 million barrels. In other words, electric cars alone will cut oil demand by 5%.

This contradicts OPEC’s forecasts. This organization predicts an increase in oil demand until 2045. But it is important to remember that OPEC includes the largest oil-exporting countries, which are keen on advocating for the indispensability of fossil fuels and demonstrating an increase in their significance.

Photo: At the end of November, several OPEC countries voluntarily reduced oil production by a total of 2.2 million barrels per day for the first quarter of 2024. The decision was announced after the 36th meeting of OPEC and non-OPEC country ministers held online. Source: Shana.

Restrained Forecasts and Lackluster Sanctions

The International Energy Agency (IEA) anticipates that the daily consumption of oil in 2024 will reach 102.3 million barrels, signifying a modest 1.2% increase compared to 2023.

The OPEC+ member states, holding sway over more than 40% of global oil production, intend to reduce output by 2.2 million barrels per day from the beginning of 2024. This figure was added to a production cut of 1.3 million barrels per day, that previously implemented by Saudi Arabia and Russia. Consequently, the actual reduction in output will be around 3,5 million barrels per day.

OPEC+ acknowledges that the production cut won’t accelerate price growth. The primary reasons for this are the sluggish global economic expansion in 2024 and the surplus of oil supply relative to demand.

Price expectations are tied precisely to concerns about a more sluggish global economic growth. Hence, the IEA has significantly lowered its oil price forecast for 2024 from $94 to $82.6 per barrel. Similarly, analysts at JPMorgan Chase & Co hold a similar view, predicting oil prices to hover around $83 per barrel in 2024. Goldman Sachs, less focused in its projections, suggests that oil prices throughout 2024 could fluctuate widely, ranging from $70 to $100 per barrel. Importantly, the production cut won’t pose a problem for consumers, as non-OPEC countries, including the United States, Norway, Mexico, and Venezuela, can compensate for it.

It’s worth noting the impact of anti-Russian sanctions on the oil market. Unfortunately, the ban on selling Russian crude oil at prices exceeding $60 per barrel, in effect for exactly a year, hasn’t proven tight enough to influence the markets significantly.

The Russian Federation has managed to route around 75% of oil supplies from under these restrictions through companies it controls in India, China, Turkey, Saudi Arabia, and the UAE, as well as utilizing a shadow fleet of tankers. While a significant portion of this oil is essentially sold illegally, it blurs the supply on the open market and only partially pressures prices.

Conclusions have already been drawn, and the U.S. and the EU have started their homework on imposing so-called secondary sanctions. Specifically, entities associated with Russian sanctions violators, companies from various countries, and even individual tankers regularly face new sanctions in the second half of this year. It appears that an informal coalition of developed countries is emerging to close the loopholes through which Russia circumvents oil sanctions.

For this purpose, as evident from reports, representatives of the U.S. Department of State are holding several meetings in London and Brussels early this week to discuss ensuring the restraint of prices for Russian oil. However, countries that initiated oil sanctions will need some time to refine sanction mechanisms and strengthen coordination in their implementation.

Source: The Gaze